doordash quarterly tax payments

From Fine-Dining to Fast Food DoorDash Delivers Your Favorite Restaurants. As a business owner you also need to know the.

A Beginner S Guide To Filing Doordash Taxes 4 Steps

January 1 March 31.

. No because Dashers are not employees DoorDash does not withhold FICA taxes from their paycheck. The same way it works for anyone who pays their taxes quarterly and uses the calendar year as their fiscal year. There is no defined amount that you should withhold because this figure depends on factors such as your taxable income or filing status.

Second Quarter Estimated Tax Payment Due. Thats 12 for income tax and 1530 in self-employment tax. Dude if you only made 1000 all year I wouldnt even mess with quarterly taxes.

Ad Order right now and have your favorite meals at your door in minutes with DoorDash. IRS doesnt want you to end up with a huge bill you cant pay. 4d edited 4d.

As such DoorDash doesnt withhold the taxes for you. Ad Order right now and have your favorite meals at your door in minutes with DoorDash. From Fine-Dining to Fast Food DoorDash Delivers Your Favorite Restaurants.

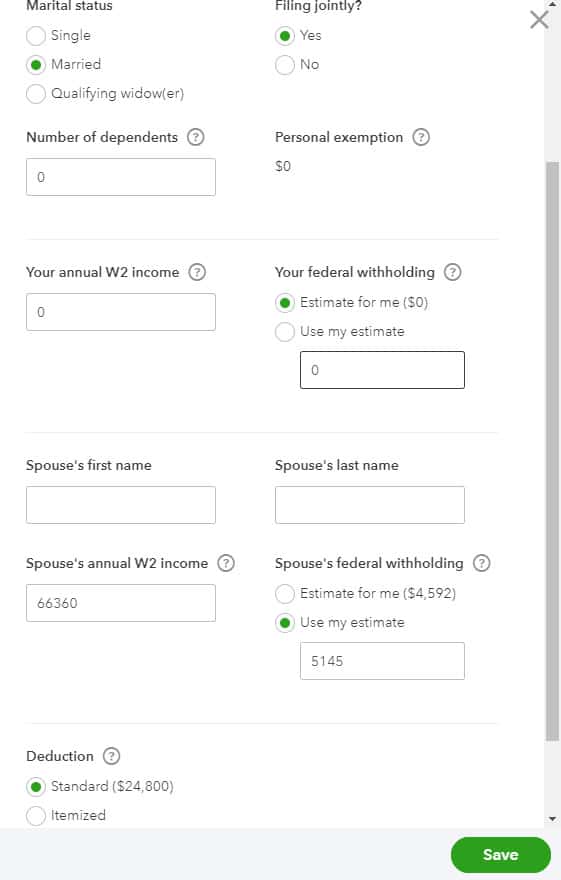

If you made estimated tax payments in 2020 towards your federal state or local taxes enter them in the Estimated and Other Income Taxes Paid section. And 10000 in expenses reduces taxes by 2730. Im new to this independent contractor business and come from the corporate world so not familiar with the concept of quarterly taxes.

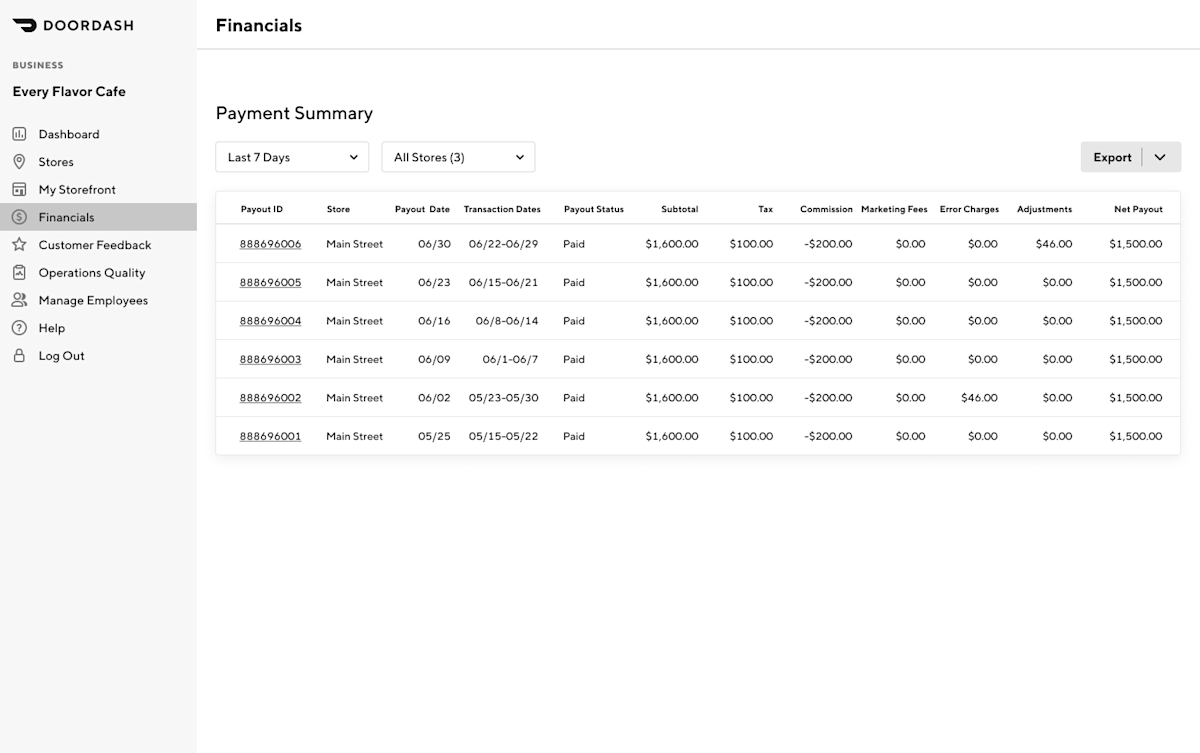

You can unsubscribe to any of the. If you want to update your store details such as menu store hours address and giving employees account access the quickest way is through the Merchant PortalBelow are. Internal Revenue Service IRS and if required state tax departments.

Generally you can expect the IRS to impose a late payment penalty of 05 percent per month or partial month that late taxes remain unpaid. Instead you must pay them yourself at tax time or if you make enough by making estimated tax payments throughout the. You can follow the step-by-step process of filing paying your quarterly taxes in QuickBooks Self-Employed.

Up to 8 cash back At DoorDash we promise to treat your data with respect and will not share your information with any third party. On April 15 June 15 Sept 15 and Jan 15 you owe an estimate of the taxes you. A 1099-NEC form summarizes Dashers earnings as independent.

It is losing money though and a slowdown in revenue growth does not help much to support its stock price. While 45 states have a sales tax about 38 states collect both state and local sales tax so be aware of your local sales tax rates. Doordash quarterly tax payments.

If youre purely dashing as a side hustle you might only have to pay taxes one a year. Tax payment is due April 15 2021. The IRS may suggest quarterly payments if you expect to owe more than 1000 in taxes this year.

The rule of thumb is to set aside 30 to. D-40ES Estimated Payment for Individual Income Tax Detach at perforation and mail the voucher with payment attached to the Office of Tax and Revenue PO Box 96018 Washington DC. If the 1099 income you forget to.

Your late fee is gonna be like 10 if that lol. The forms are filed with the US. Third Quarter Estimated Tax Payment Due.

If you expect to owe the IRS 1000 or more in taxes then you should file. I save about 25 of my dd earnings in a separate account. Payable sent out the invitations to file.

My understanding is that 1099. Youll receive a 1099-NEC if youve earned at least 600. Doordash requires all of their drivers to carry an insulated food bag.

Dasher 1 year. DoorDash has a lot of cash to grow its operations. April 1 May 31.

Each year tax season kicks off with tax forms that show all the important information from the previous year. If you didnt select a delivery method on your account DoorDash automatically mails and emails your 1099-NEC to the address on file by February 1. Instead Dashers are paid in full for their work and must report their.

Tax payment is due June 15 2021. If you drive your car for your deliveries every mile is worth. In QuickBooks Self-Employed go to the Taxes menu.

Ultimate Tax Guide For Doordash Lyft And Uber Drivers For 2022 Youtube

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

There S Free And Then There S Me As Your Tax Preparer I Promise To Offer A True Concierge Tax Experience I Make I Tax Money Tax Preparation Turbotax

How Do I Calculate Quarterly Taxes Estimates For Doordash Grubhub Uber Eats Postmates And Other Gig Work Entrecourier

Makenzie Way 2020 Graduate Of Penn Law Reached Out To Mike Sims President Of Barbri To Get The Answers To H Organizational App Phone Deals Wedding Planning

The Best Guide To Doordash Driver Taxes In 2021 Everlance

![]()

Makenzie Way 2020 Graduate Of Penn Law Reached Out To Mike Sims President Of Barbri To Get The Answers To H Organizational App Phone Deals Wedding Planning

Quarterly Tax Payment For Doordash Grubhub Drivers Entrecourier

Prepare For Tax Season With These Restaurant Tax Tips

How Much Do People Actually Make From Gigs Like Uber And Airbnb Sharing Economy Financial Aid For College Financial Aid

How Do I Calculate Quarterly Taxes Estimates For Doordash Grubhub Uber Eats Postmates And Other Gig Work Entrecourier

Taxes For Freelancers For All The Visual Learners Out There This Board Is For You We Ve Condensed Complicated Tax Topics Online Taxes Tax Guide Diy Taxes

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

Prepare For Tax Season With These Restaurant Tax Tips

How Does Doordash Do Taxes Taxestalk Net

Makenzie Way 2020 Graduate Of Penn Law Reached Out To Mike Sims President Of Barbri To Get The Answers To H Organizational App Phone Deals Wedding Planning

Doordash Taxes 2022 A Complete Guide For Dashers By A Dasher